Welcome to the Budget page for the Avon Central School District. This page is intended to be a conduit for information between the school and community regarding the annual budget planning process. Please see the links to the right to review budget information organized by school year.

Any questions or comments regarding this information can be directed to the Board of Education and Superintendent by contacting Jennifer VanRy, the District Clerk, at (585) 226-2455, ext. 1320 or jvanry@avoncsd.org.

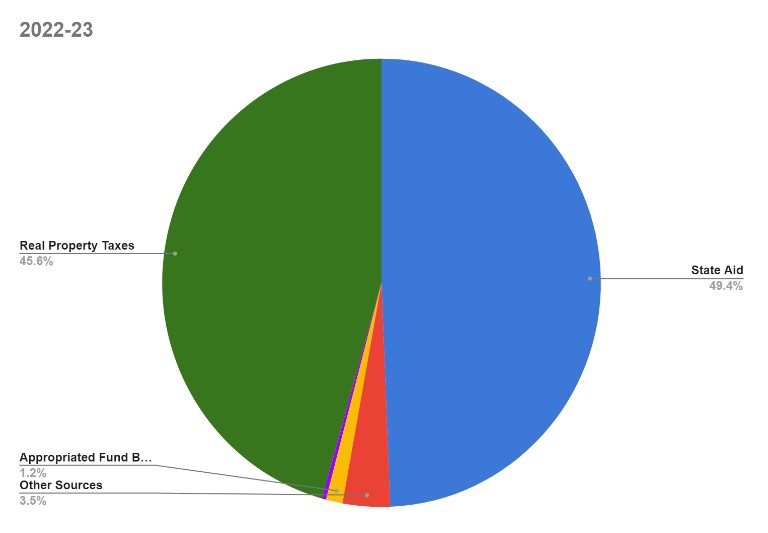

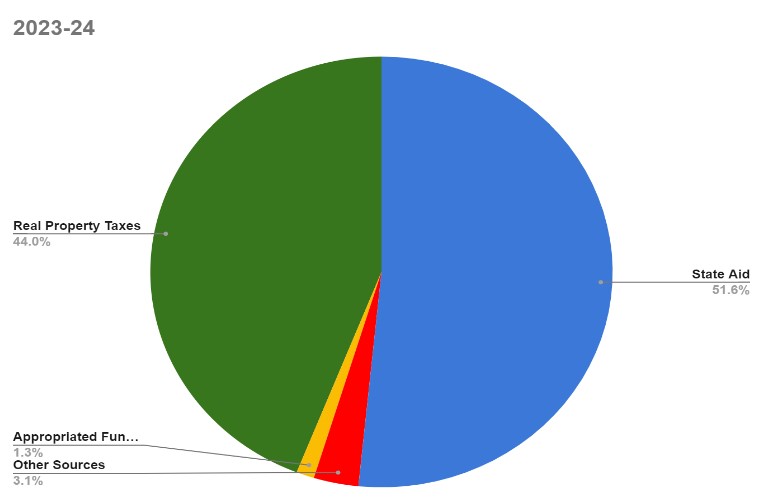

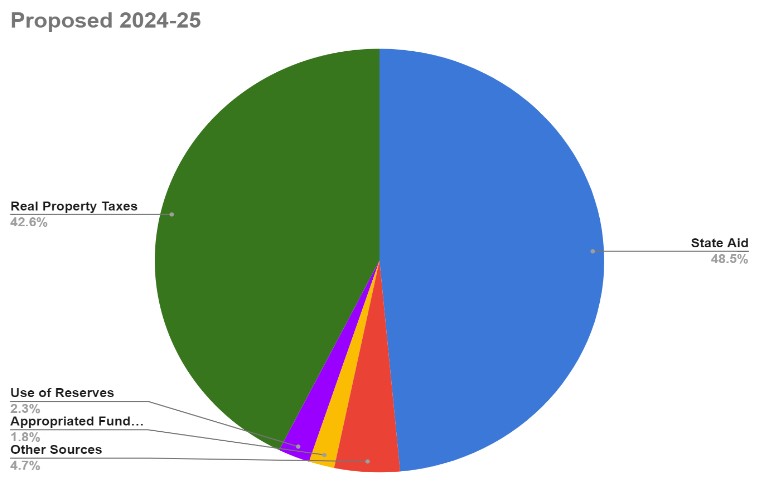

Overview of School Budget Revenues

Public education is a commitment to our democracy. Aristotle and Thomas Jefferson alike felt that educating “citizens” is fundamental to being a government of the people. Citizens need to be informed AND they need to know how to evaluate information in order to create knowledge. It is not perfect. Schools are not perfect, but it is a noble cause upon which we try to deliver.

Schooling also plays an important role in the economy. Whether it is preparing students for the workforce, college, or military service; education IS preparation.

Lastly, it cannot be lost, and we certainly felt the impact during COVID, that families need to be able to tend to their employment and careers. It is truly a brilliant collaboration that public education prepares future generations while allowing many family members to earn incomes.

There is no doubt that educating citizens requires investment. So where do the resources come from? In the sections below we will take a closer look at three primary revenue sources for each school district: 1) New York State (NYS) School Aid 2) the Local Tax Levy, and 3) Other sources of revenue. We will look at how these sources interact and what role each has played over the last 2 years as we plan for the 2024-25 school year.

Important Dates

Budget Documents

Additional Resources

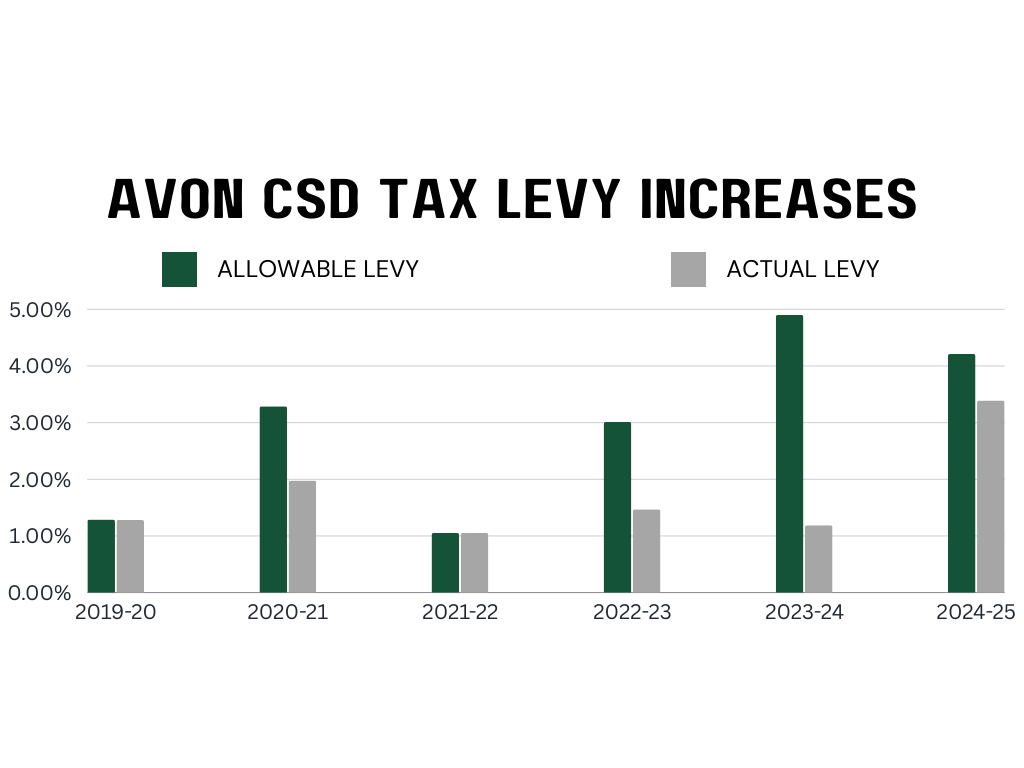

Let’s take a closer look at Avon’s allowable tax levy calculation over the years.

The graph below shows the ‘allowable’ tax levy calculation versus the ‘actual’ tax levy for the district. The graph shows the last 6 years. In 4 of the 6 years, ACSD built its annual school budget with a tax levy below what the allowable formula has shown for the district. In other words, the allowable calculation suggested a tax levy higher than what the district actually pursued. The requirement to be transparent about the allowable levy established by NYS put in place some tax protection for the community as it relates to school taxes. The graph shows that ACSD has extended additional tax considerations as part of its budget building by proposing and then raising the levy by a percentage below the allowable rate. In the last two years, this was made possible by NYS’s commitment to fully fund foundation aid. Since its inception in 2012, ACSD has never pursued an actual tax levy over the allowable calculation. To do so would require a supermajority (60% approval or more). Since its inception, ACSD has pursued a levy below the allowable calculation in 6 of the last 13 years.

As explained in another communication regarding school aid, NYS originally tried to provide less school aid to Avon for the 2024-2025 school year than we received in 2023-2024. Frankly, this made no sense. We all know that costs have gone up. The final adopted NYS budget was only a slight improvement over the Governor’s original proposed budget. NYS Foundation Aid for ACSD in the 2024-2025 school year will be even with the funds for the current school year. Again, we all know that costs have gone up.

As we build the 2024-2025 budget, ACSD has to build a balanced budget based on the known economic circumstances. We know that NYS-provided Foundation Aid will remain flat. The final allowable tax levy calculation for the coming school year is 4.21%. If the proposed school budget is approved by the voters, the final actual levy will be 3.39%. These two revenues will not provide all of the funding that is needed to meet mandates and deliver programs, so we will leverage other revenue streams, including reserves. This is an appropriate approach given a number of unique circumstances this year. However, it will not be sustainable for ACSD to consistently tax below allowable calculations and spend from reserves if NYS flattens or lowers school aid.

For more information about the tax cap and how it impacts our district's finances, watch the presentation below from Dr. Rick Timbs, executive director of the Statewide School Finance Consortium. Dr. Timbs presented in March 2024 on the components of the tax cap formula with an emphasis on Avon’s tax cap history.

Other Revenue Sources

In most years, approximately $.96 of every $1.00 of revenue comes from NYS School Aid and the tax levy. In most years, 3-5% of revenue must come from other revenue streams. What are these other revenue streams? There are three basic potential revenues that make up the “Other” component: 1) Payments in Lieu of Taxes (PILOTS), 2) Unappropriated Fund Balance, and 3) Specific Reserves.

Payments in Lieu of Taxes (PILOTs): Payments in Lieu of Taxes, or PILOTS, are an economic development tool. They are frequently put in place to encourage economic investment. The idea being that there is a long-term community good by helping to encourage business development. The PILOTS can be large or small. There are guidelines and requirements as to their development, but the terms can vary from project to project. When an agreement is in place the payments made are divided between the impacted traditional taxing jurisdictions. For school districts PILOT payments create an exclusion in the tax formula. The revenue is treated separately from actual levied taxes. Let’s look at another hypothetical. The terms of this fictional example are exaggerated.

Imagine a new business enters into a PILOT agreement for $10,000 in a very small school district. If the new business makes a direct PILOT payment for $10,000, typically about $6,400 would go to a school district (again, terms vary). Hypothetically, the levy in this fictional small village is $100,000. So the school district revenues related to the PILOT and levy are $106,400 ($6,400 paid by the business PILOT and $100,000 paid by property owners). In order to arrive at the total paid by all property owners, each owner pays an amount of that total $100,000 levied that is exactly proportional to the percentage of the total property value. The relative value of all of the property in the district subject to taxes must be calculated. If there were 10 total properties in this tiny fictional school district, each worth an even $100,000 dollars, then the total property wealth would be $1,000,000 and each home would represent 10% of the total property value. In this fictional case, each home would then be levied a tax of $10,000 to make the total levy of $100,000.

When a PILOT agreement expires, that amount of payment is then incorporated into the levy, so there is an interesting impact on the levy when a PILOT expires. Take the example above.

When the PILOT agreement above ends, that amount of money is factored into the allowable levy and the property where the business is located goes into the property wealth calculation as well. This will impact the levy calculation. If nothing else changed in our small fictional district, then the new levy would be $106,400. But there is new property counted in the total property value. The value of the business must be considered now that it is off its PILOT agreement. Let’s say the assessor finds this new property is worth $300,000. Now the total property value is $1,300,000 (Business at $300,000 plus the 10 other properties at $100,000 each). The number of properties and total value of the properties changed. Now there are 11 properties so a new tax calculator is needed. The business will need to pay its proportionate percentage of the total levy based upon its proportion of the total property value.

$300,000 / $1,300,000 of total value means the business now represents 23% of the total taxable property values. Therefore, it becomes responsible for 23% of the total tax levy. In our simple fictional example, the business would begin paying 23% of $106,400 or $24,472. Then, the other property owners would pay 10 equal portions of the remaining levy. $106,400 total levy minus the $24,427 paid by the successful new business means $81,928 of the total levy still needs to be paid. Each owner of the $100,000 properties would then have to pay $8,192. This is how it might work in a very small fictional district that welcomes and supports a successful new business.

When we zoom out to an entire district, it gets much more complicated. PILOT agreements of various scopes, distributions, and durations exist. These properties come into the levy and out of the levy. Property values are not equally distributed and can vary greatly. Modifications and home improvements are made. Sadly, natural events/catastrophes can wipe out a property’s value. Municipalities tax at different rates and individual properties are taxed at different rates depending upon purpose. Plus, the allowable calculation considers other historical economic factors as well. At the macro scale, it gets quite complex and is constantly changing. In summary, PILOT agreements create some wrinkles in school budget calculations that must be accounted for.

Specific Reserves: School districts, by law, can create specific reserve accounts. Reserves help the district to manage both long-term planning and unanticipated volatility in budgets. They help to ensure program viability while also managing potential disruption to students, staff, and the community as a whole. Reserves can be designated as restricted or unrestricted. As an example of a restricted reserve, the voters approved a reserve for Capital Expenses in 2021. The establishment of this reserve account required the voting public. In requesting approval, ACSD communicated: the purpose of the reserve, the funding limit of the reserve, and the funding duration of the reserve. The voters approved the creation. It was created as a 10-year reserve, with a $5,000,000 limit. The reserve was opened and approved in 2021. Through the budget transfer process, the Board of Education can move monies into an approved restricted reserve, but the amount placed in the reserve cannot exceed $5,000,000. The monies in the reserve can accrue interest so it is possible for the amount to exceed $5,000,000 but the total transfers cannot. The money in the restricted reserve can only be spent for the designated purpose, if and only if, a referendum is put before the voters and the voters approve the spending. Monies can remain in the account after 10 years, but no new deposits can be made. Monies placed in this restricted reserve cannot be used to assist with the school budget. It is a well-regulated budget provision.

An example of an unrestricted reserve is an Unemployment Reserve. This type of reserve can be created by Boards of Education. The specific purpose must be identified. In this case, the reserve exists to help the district to manage unemployment payments that may be needed for former workers. The Board of Education has the authority to transfer funds to and from the reserves so long as the actions are taken publicly. Occasionally, funds in these unrestricted reserves may be needed to assist the budget planning process. In these instances, the district communicates that it will be accessing reserves as a revenue needed in the budget planning process. The district aligns the use of the funds with the stated purpose for having the reserve. For example, the 2024-2025 proposed school budget intends to use funds from three reserves as revenues which are aligned to the specific purposes of the reserves.

Appropriated Fund Balance: Appropriated fund balance is the amount of fund balance that the Board of Education desires to legally authorize as a financing source to help fund the following year’s budget.

The Big Picture

School budgets are created and balanced on a year-to-year basis. The monies come from three primary sources. These sources are connected. The biggest driver of revenue is and should be the state of New York. Our state in general supports its schools considering the amount of total resources, however, it is an unpredictable partner in this process. And, in spite of its delivery of resources year-to-year, it also attaches a lot of strings to the process. Some of the strings serve as good guardrails to keep community impact in check, and some of the strings contribute to the need for the resources. New York Schools are among the most regulated and as such we are at times required to spend more. Recent examples for Avon include the unfunded mandate to address our name and imagery. This mandate came from the State Education Department with no related funding for schools to address the requirement. Another example is when students are out of school for unique reasons, we used to be required to provide 2 hours of tutoring per day to students in grades 7-12, we are now required to provide 3 hours, a 50% increase with no additional funding. For students in UPK-6, the requirement moved from 1 hours to 2 hours per day.

There is another large mandate on the horizon that we have started planning for as a district and it has the potential to be financially devastating: zero emission school buses. Regardless of one’s relative thinking about the need to protect and preserve the environment, there is a regulation on the books that will require all schools to transition their bus fleet to zero emission school buses (electric is the most common solution at this time) by 2035. In general, these buses will conservatively cost $225,000 more than our current school buses. By and large, we manage our fleet by replacing one to two buses a year. Conservatively, we will need to dedicate an additional $450,000 to purchase school buses annually. At the same time, NYS is looking to lower Avon’s Foundation Aid. There will be a variety of incentives and grants, but this playing field is relatively undefined as the infrastructure will need significant study. It is premature and financially irresponsible for ACSD to rush into proposing the purchase of zero emission buses before more systematically researching the true implications.

The Board of Education represents the community in its commitment to uphold the Constitution of the United States and New York State. The Avon School Board has done a tremendous job managing the long-term financial health of the district while also demonstrating strong commitment to the educational needs of the students of the community. Increasingly, this middle ground is hard to find, and the economic impact will be felt in different ways. Please rest assured that the Avon Board of Education will remain committed to its responsibilities to the learning community as a whole- students, staff, families, and the community at large. We will continue to work hard to provide excellent programs in cost effective ways.